SHIFT

Credit and payment platforms for business

Cloud data management portal

Cloud data management portal

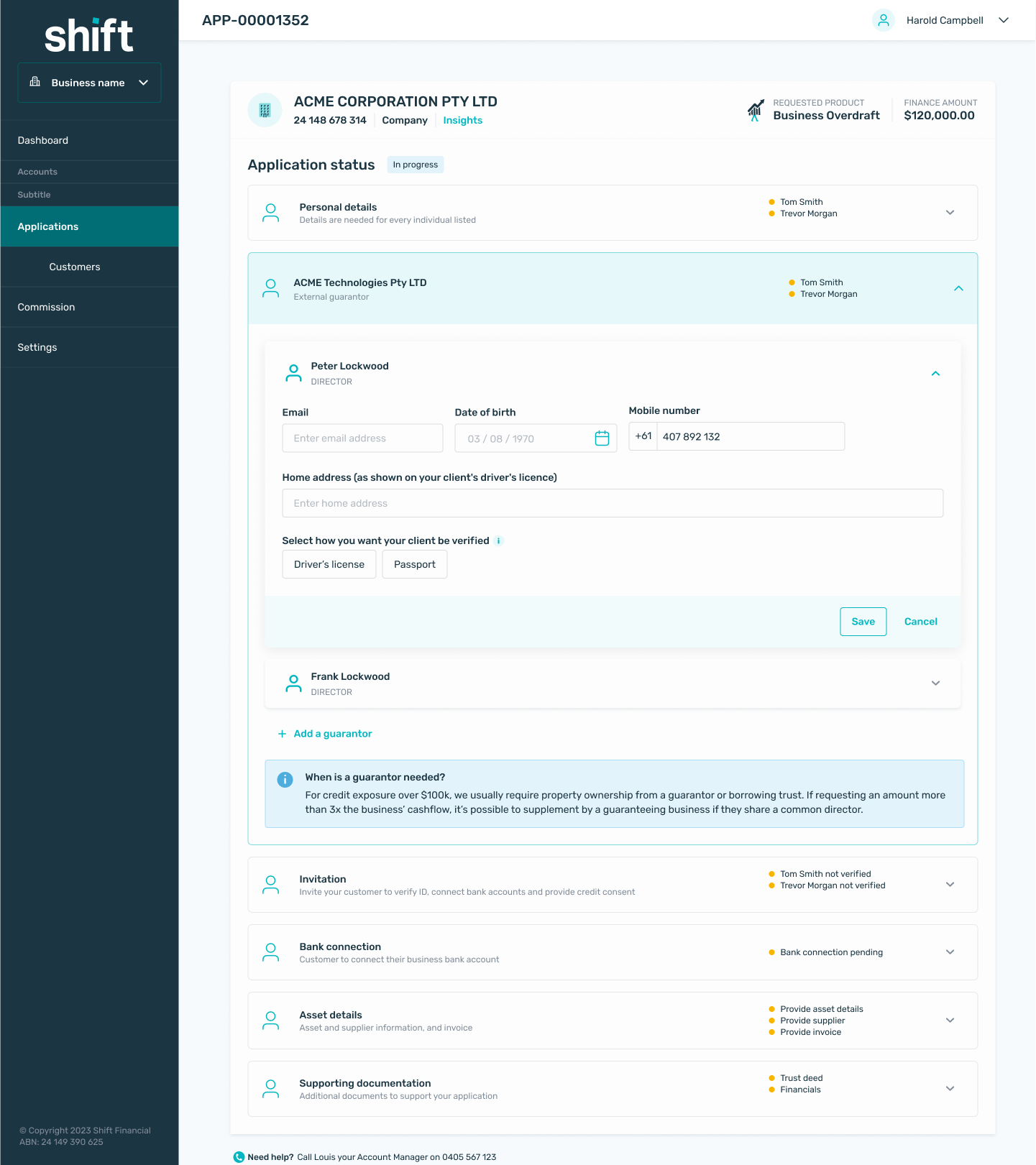

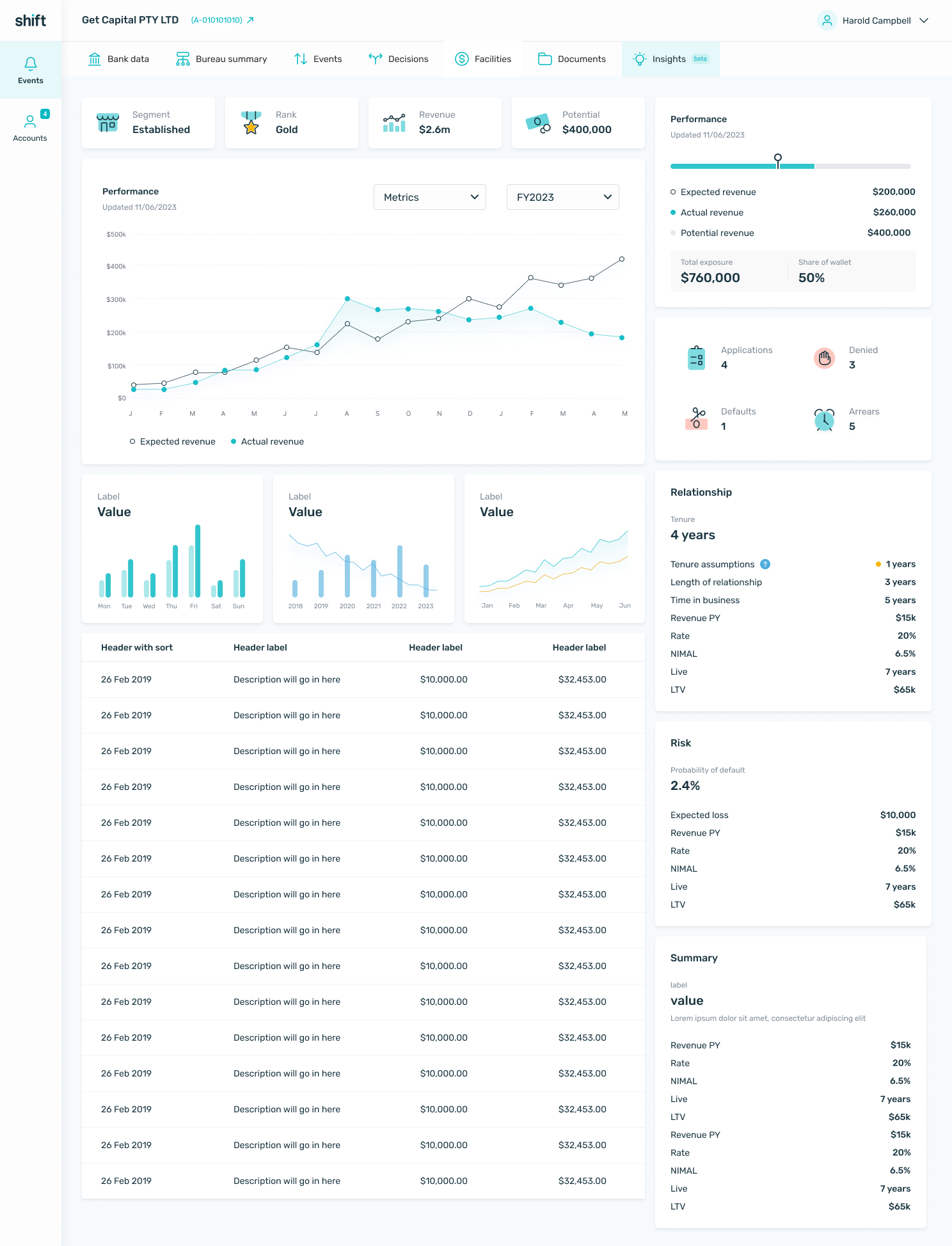

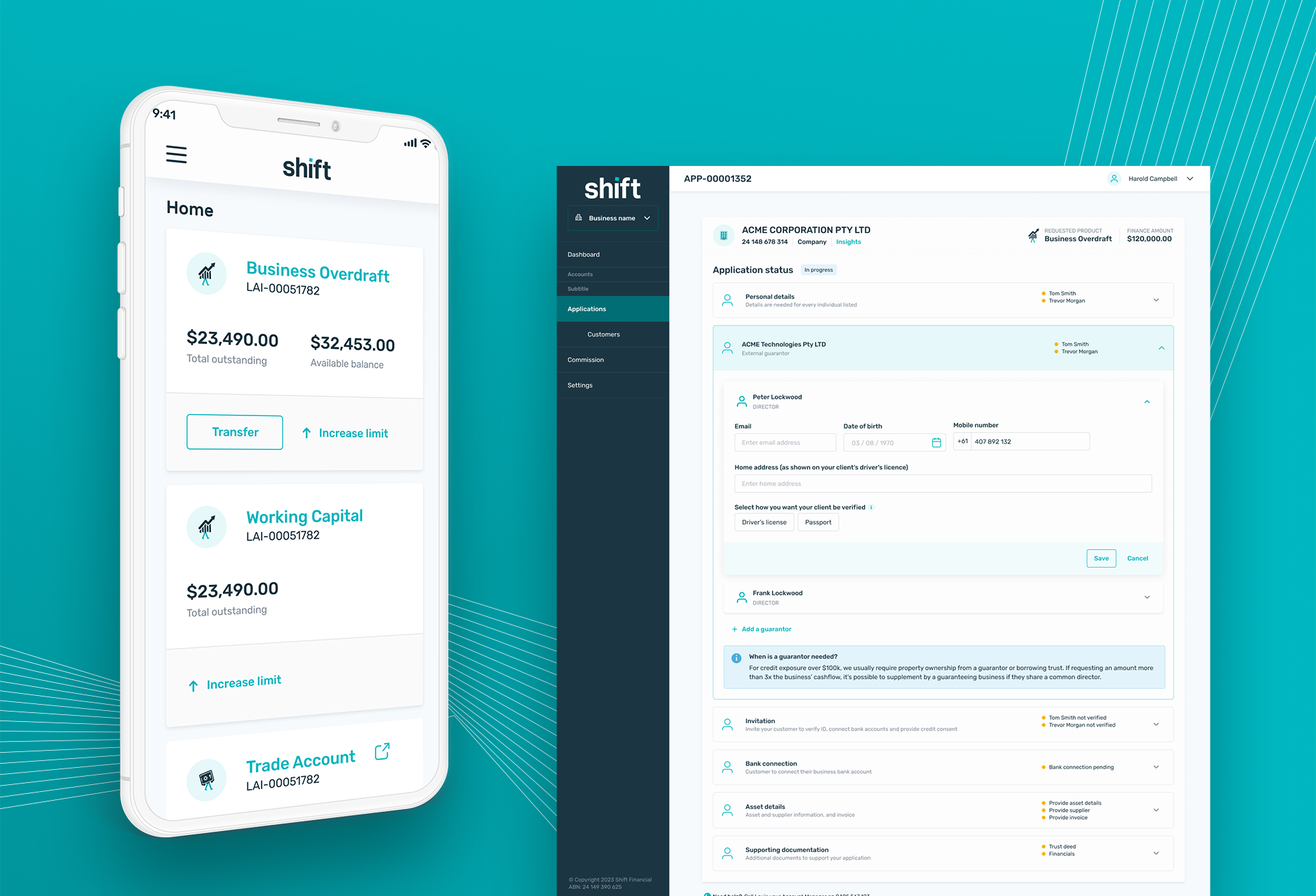

I joined Shift to help uplift their design language, redesign their platform, and help remove user pain-points. During my contract I delivered a number of features that had measurable positive impact to the business, and set the direction for their future product strategy and growth.

RESPONSIBILITIES

Creative Direction, Visual Design, Design Language, UX, Interaction Design

Improving the UX goes more than skin-deep

Every cloud

Every cloud

Shift is a successful scale-up based in North Sydney, and I joined the team to help improve the UI and UX of their flagship products. I fostered a collaborative environment with their engineering team, working closely with them to deliver documented React components via Storybook.

As well as the design language and component library, I also worked on an animation and interaction library to help bring the platform to life. These were stress-tested on the features I delivered, which were extremely successful and greatly improved customer retention while reducing reliance on the customer service chanels.

User research to unlock the problem space

Usability testing quickly exposed why users were feeling anxious about the edit installments process. People weren’t sure if their changes had gone through, what would happen next, or how adjustments would affect their payments.

Terminology was confusing, and poor system feedback led to hesitation or calls to customer support. The sessions made it clear this wasn’t just a UX flaw – it was a trust issue. The fix would be about restoring confidence through clearer messaging and real-time feedback.

Workshops surfaced the key pain points

Through a series of internal workshops, we unpacked user feedback to understand what really mattered to business owners needing to pause or adjust repayments. Many were dealing with unpredictable cashflow and wanted flexibility without feeling penalised or unsure of the impact.

The sessions revealed that users struggled to understand how a deferred payment would affect their schedule, total cost, and interest over time. Existing messaging was vague, and the process felt opaque and transactional. Mapping these issues alongside real customer scenarios helped the team see that the problem wasn’t just functional, it was emotional.

Journey mapping

To address the complexity of the existing edit installments flow, I created a series of detailed journey maps that captured every step, decision point, and system interaction within the process.

By mapping the journey across key states – request initiation, eligibility check, schedule recalculation, confirmation, and follow-up – I identified where users were losing confidence and where systems were introducing unnecessary friction. I simplified the flow by reducing system touchpoints, clarifying language, and introducing contextual feedback to make each stage predictable and transparent.

The revised maps were refined closely with engineering to align with existing notification and repayment frameworks, ensuring technical feasibility and consistency. This collaborative approach not only reduced delivery complexity but also created a scalable blueprint for future repayment-related journeys requiring similar transparency and reassurance.

Confirming friction points

Creating the journey map for the installments flow was a pivotal step in uncovering how fragmented and opaque the experience had become.

By mapping every touchpoint across user actions, system processes, and internal teams, I was able to visualise the full ecosystem and identify friction points that weren’t immediately visible in analytics or support feedback alone.

The mapping exercise revealed three key insights:

- Lack of transparency created hesitation.

Users were often unsure whether repayment changes had been processed successfully. The absence of real-time feedback and confirmation eroded trust, prompting unnecessary calls to customer support. - System touchpoints were unnecessarily complex.

Multiple back-end services were triggered sequentially, causing latency and inconsistent messaging. Simplifying the journey to reduce system dependencies improved both performance and user confidence. - Communication and compliance were out of sync.

Updates to repayment schedules required sign-off from compliance and risk teams, yet their input occurred late in the process. Bringing these stakeholders into early design stages helped ensure regulatory requirements were embedded from the start, rather than applied retroactively.

The refined journey map also emphasised the need for clearer system feedback and simplified messaging, which led to the introduction of a side-by-side comparison feature and an improved notification framework. These enhancements transformed a previously confusing process into a transparent, self-serve experience.

Ultimately, the journey mapping work didn’t just streamline one feature - it created a reusable blueprint for mapping other financial workflows within the product. The outcome was a more predictable, trustworthy, and scalable design foundation that balanced user empowerment with regulatory compliance.

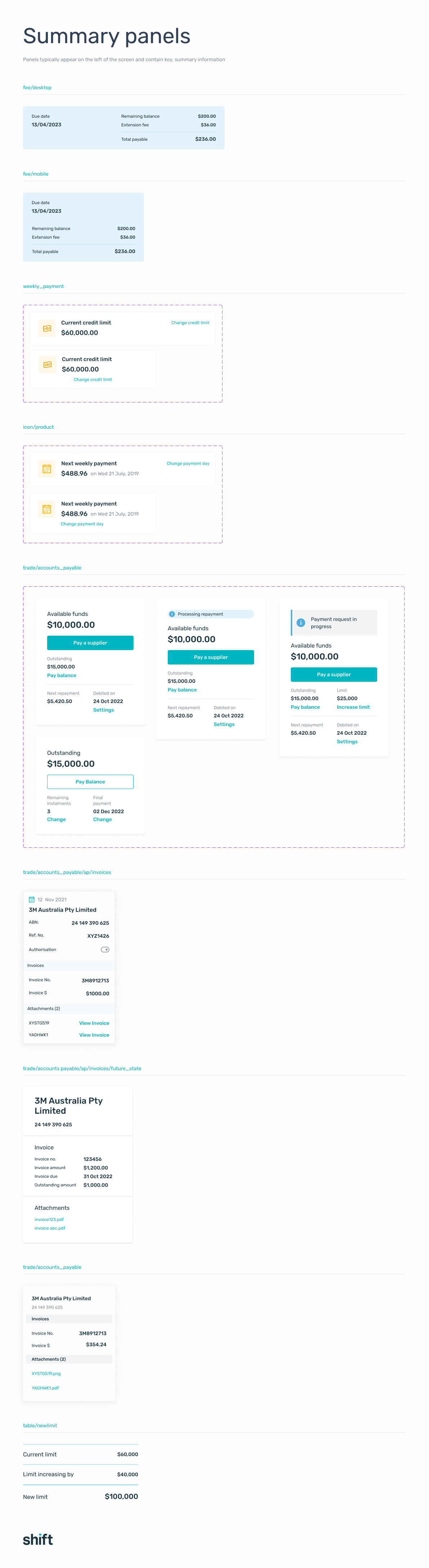

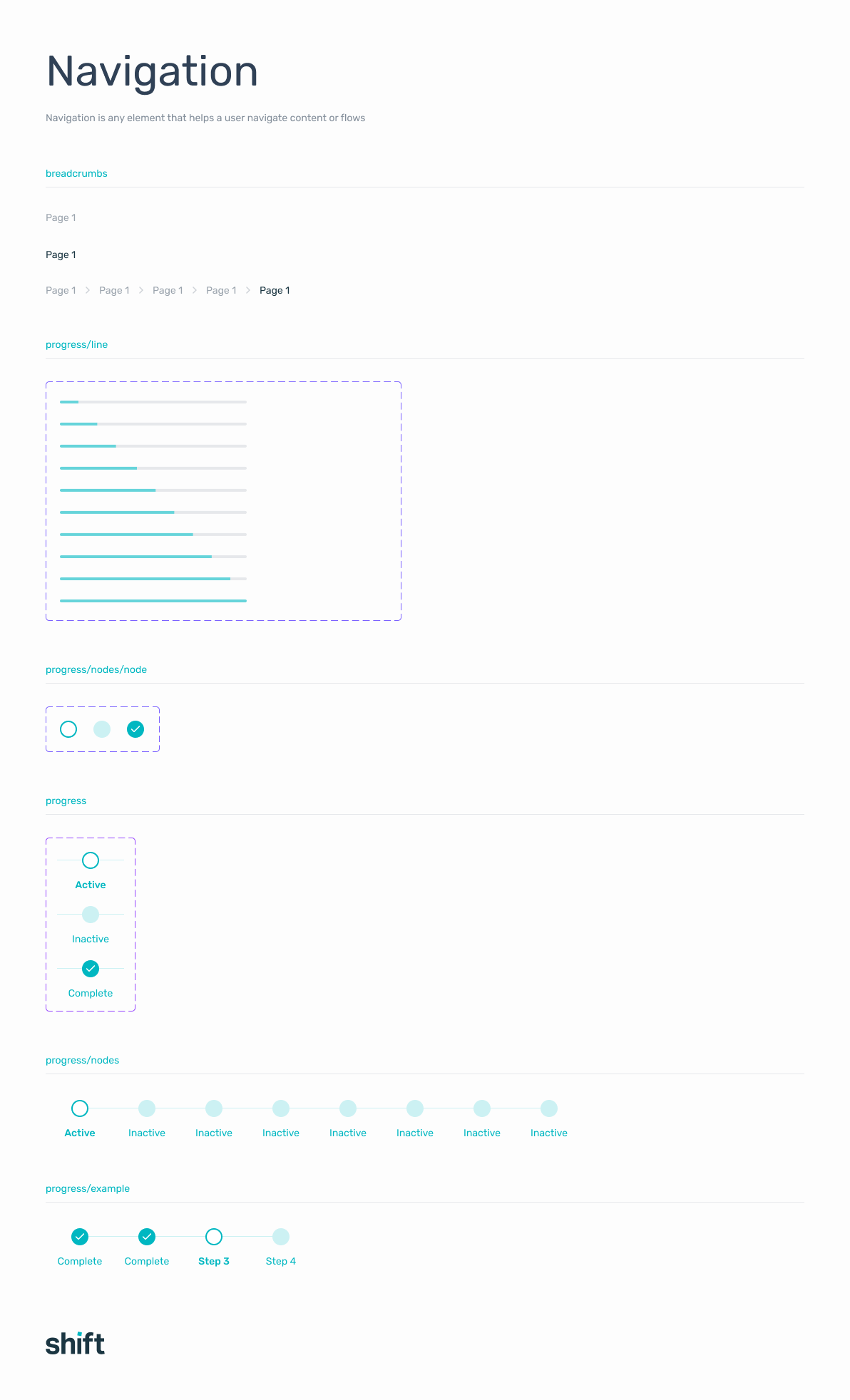

An updated component library

Implementing the new journeys highlighted several gaps within the existing component library. Many of the interface elements - particularly notifications, progress indicators, and status messages - lacked the flexibility to support the richer feedback and dynamic states introduced in the redesign.

To address this, I initiated an update of the component library, introducing new variants for banners, inline alerts, and confirmation patterns that could scale across both web and native platforms. These updates ensured consistency in how system feedback was surfaced, while also reducing reliance on ad-hoc design solutions.

This work formed part of a broader design language refresh I was championing across the product. The aim was to modernise the visual system, tighten typographic hierarchy, refine spacing and motion principles, and unify interaction behaviours. By evolving the library alongside the journey improvements, we created a more coherent and trustworthy design ecosystem - one capable of supporting future feature development with far greater speed and consistency.

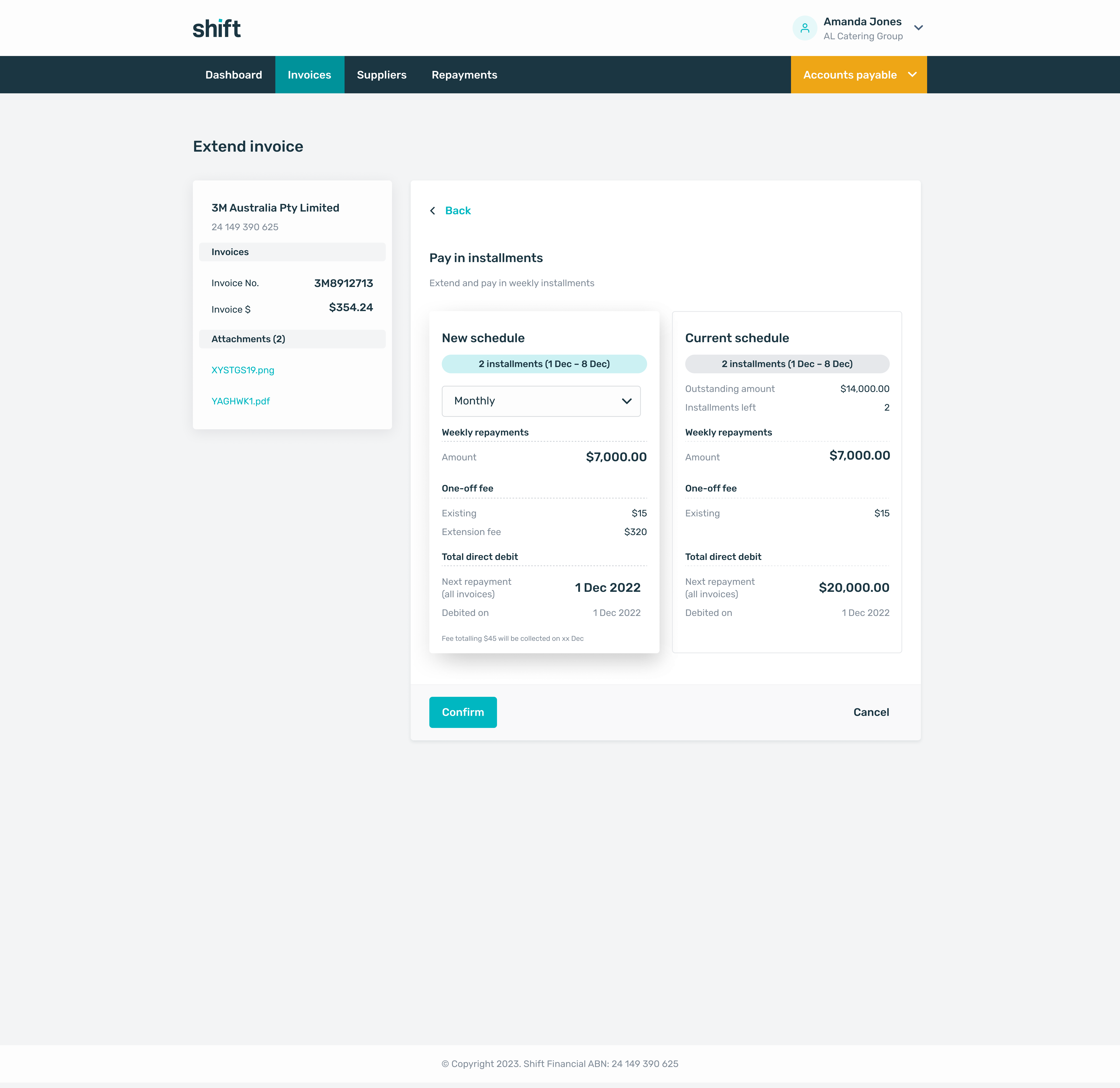

Side by side comparisons provide clarify

As part of simplifying the decision-making process, I introduced a side-by-side comparison feature that allowed users to clearly view the impact of their installments change before confirming. The interface presented the current and proposed payment schedules, repayment amounts, and interest figures in a concise, easy-to-scan layout.

This visual comparison removed the ambiguity that previously caused hesitation and confusion. By making the financial implications transparent upfront, users could quickly assess affordability and proceed with confidence. The design emphasised clarity through typographic hierarchy, colour cues, and consistent alignment with the refreshed design system.

Early testing showed a noticeable reduction in user uncertainty and a marked improvement in task completion rates, confirming that greater transparency and visual clarity were key to building trust in the journey.

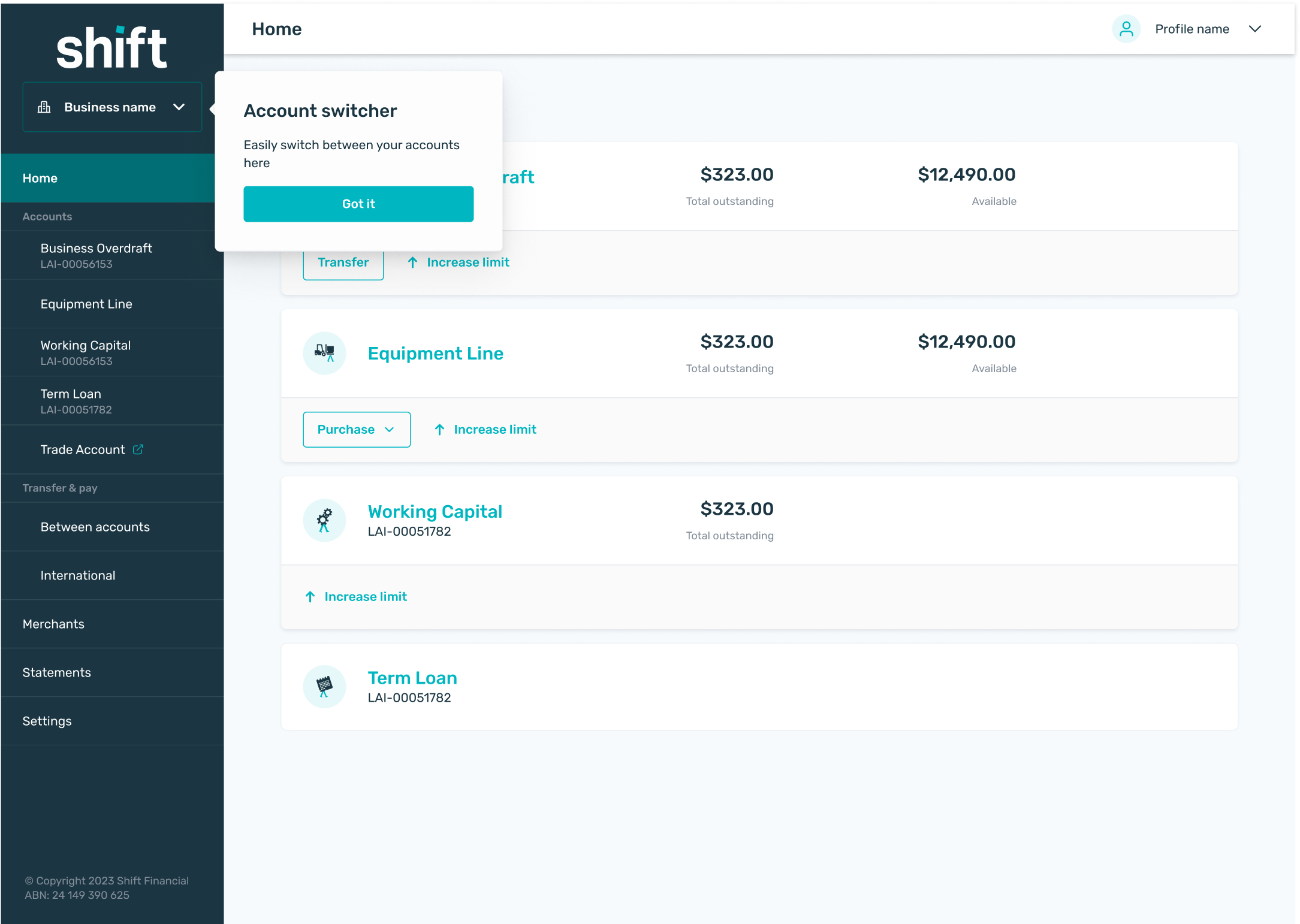

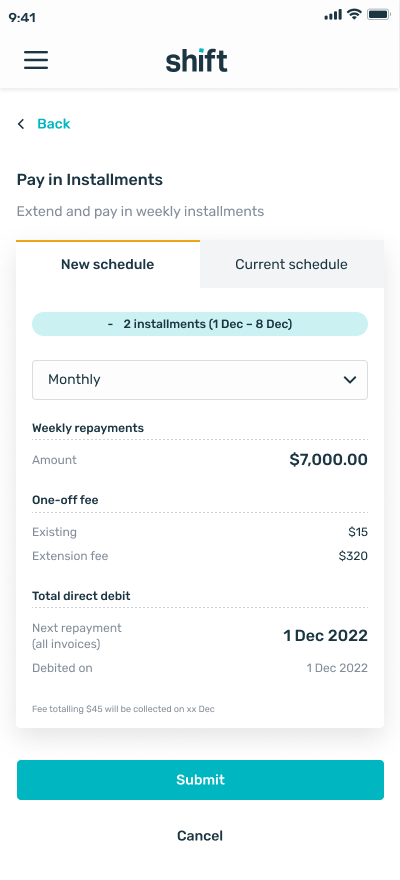

Adapting for customers in any line of work

Analysis of user behaviour revealed that a significant proportion of customers accessed their accounts while on the move - outside work, travelling, or during short breaks - rather than from a desktop or laptop. Many limit changes were prompted by spontaneous needs such as booking travel, managing expenses, or handling unexpected costs, meaning accessibility and ease of use on mobile were essential.

To support this reality, I ensured the redesigned experience was fully responsive and mobile-optimised, maintaining the same clarity and functionality across all viewports. Key layouts, such as the new side-by-side comparison view, used adaptive design to implement tabs on smaller screens. Interactive elements were refined for touch input, with increased hit areas, improved spacing, and mobile-friendly feedback states.

This focus on a mobile-first experience not only aligned the design with real customer behaviour but also strengthened inclusivity and accessibility, ensuring users could manage their credit limits confidently wherever they were.

Selected Projects

AmaysimMobile app

ABC iViewMobile app

NickelcloudSaaS platform (start-up)

ShiftPlatform redesign

P&O CruisesCruise booking website

All of UsMobile app (start-up)

Trade Finance AppStandard Chartered

Advice IntelligenceSaaS platform (start-up)